Excel training webinar

|

|

WHAT YOU GET

|

Course manual

& Excel files

|

10 minutes’

hotline time

|

Excel expertise

28 years’

specialisation

|

|

|

Business planning and investment analysis

Investment analysis, long-term planning, sensitivities and Monte Carlo

Series of 3 training webinars (attend any or all)

Duration: 60 minutes each

Duration: 60 minutes each

|

|

Format: Interactive webinar

Format: Interactive webinar

|

|

|

"It's not hard to make decisions when you know what your values are." - Roy Disney

If you are a project analyst or someone who has investment decisions to make, here

is a series of three high-value 1-hour webinars that show you how to do it in Excel.

Attending any or all of these webinars is a fail-safe investment that won't break

the bank.

|

YOUR POWER-PACKED AGENDA

|

Investment analysis

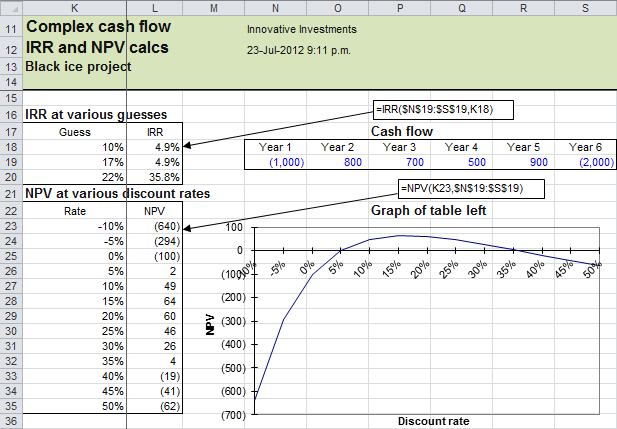

Know how to use Excel to analyse the profitability of projects. Make use of IRR,

NPV, XIRR and XNPV. Avoid common traps. Use financial functions to calculate loan

interest, principal and payments.

- Analyse project cash flows with NPV and IRR.

- Convert an annual discount rate to a monthly or other period rate.

- Beware of the traps many fall into with these functions.

- Adjust for start-of-period cash flows.

Quiz

- Use XIRR and XNPV for irregular cash flow periods.

- Build a loan amortisation schedule with PMT and IPMT.

Quiz

- Calculate cumulative principal and interest payments with CUMPRINC and CUMIPMT.

- Decide between lease, purchase or loan.

Quiz

Long-term

planning and sensitivity analysis

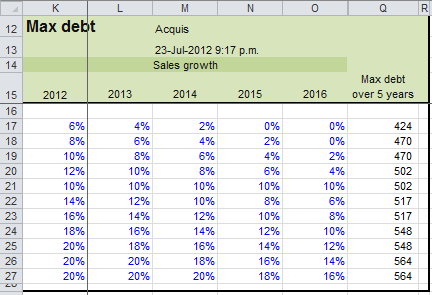

Learn long-term financial modelling in which debt and interest calculations are

a key part of the model. Also learn how to use Data Tables for running a model multiple

times and collating key results into a table.

- Set up interest and debt calculations of long-range model.

- Set model to iterate calculations appropriately.

- Remove Excel # errors from a circular reference.

Quiz

- Create sensitivity analyses by using Data Tables.

- Switch Data Tables calculation off when sensitivities are not being run.

Quiz

- Separate Data Tables into another workbook.

- Value the company.

- Set up Data Tables with multiple variables.

Quiz

Monte Carlo simulation

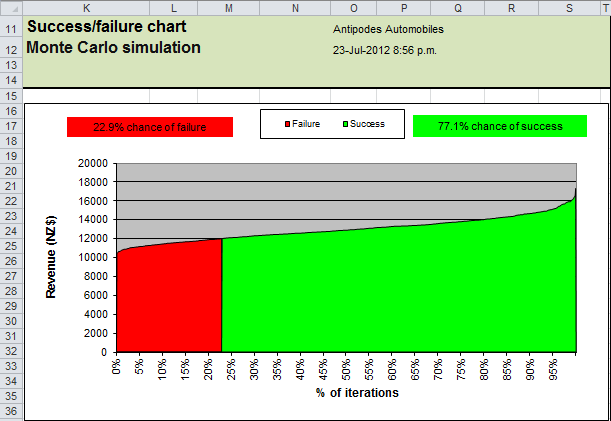

Analyse a project by running a model many times with randomness in many variables.

In other words, simulate the real world. From that, determine the likelihood of

success. It’s not as difficult as you might think.

- Incorporate randomness into projections.

- Vary multiple input values at once.

- Generate random inputs from different probability distributions.

Quiz

- Quickly run thousands of model iterations using an AbleOwl macro.

- Measure the effects of input variability on model output.

- Explicitly account for uncertainty in order to make informed decisions.

Quiz

- Calculate confidence intervals for model outputs.

- Collate and chart results.

Quiz

|

Prerequisites

Basic Excel formula creation and use of functions for all parts.

Applies to all Excel versions including 2013, 2010 and 2007. Any differences are pointed out.

|

|

PRESENTATION FORMAT

|

|

|

|

Live webinar format

See the presentation on your PC screen and hear the presenter either from your PC

speakers/headphones or on the telephone.

Type questions on the chat line during the presentation. Questions will be answered

by the co-presenter.

Stay engaged with multiple-choice quizzes.

Test out the webinar technology with one of the free Excel 10-minute tips webinars.

|

Presenters

Each webinar has a main presenter and a co-presenter, who share the presentation

and question-answering. Having two makes it more engaging, and different viewpoints expressed makes it clearer.

There are a number of different AbleOwl presenters, all of whom are Excel specialists.

|

|

Excel versions

Unless specified otherwise, all webinars cover all current Excel versions from 2007 onwards. Any differences among versions are pointed out.

|

|

|

COMPARISON OF ABLEOWL WEBINARS TO OTHERS'

|

|

Webinar characteristics

|

AbleOwl

|

Others

|

|

Two presenters share the teaching, so one can answer queries, and the dialogue between

makes the webinar more engaging.

|

*****

|

*

|

|

You’re encouraged to interact with the presenters through quizzes and chat-box discussions:

you’re not a passive observer.

|

****

|

**

|

|

Presenters are Excel specialists, can give additional insight and answer any queries.

|

*****

|

****

|

|

Each different presenter brings his/her own personality and humour(?).

|

****

|

**

|

|

You discover not only Excel parts, but also how to structure and standardise, like

learning not only words, but grammar too.

|

*****

|

*

|

|

You get a step-by-step PDF manual sent in advance to preview and review.

|

*****

|

*

|

|

You can take advantage of expert post-webinar email support to help you get the

full benefit from your new skills.

|

*****

|

*

|

|

You are provided a clear and consistent learning path, without duplication, by the

depth and breadth of webinar series topics.

|

*****

|

***

|

|

You can purchase multiple vouchers at considerable savings. |

****

|

**

|

|

|

TESTIMONIALS

|

|

|

"Great. I was able to follow really easily and it flowed along logically. Good pace.

Good to have the 2 presenters i.e. who can “chat’ about what’s being done, giving

2 points of view etc."

Debbie, Financial Accountant, Hamilton, New Zealand

"I would like to send you a thank you for the clearly presented and well paced webinar

I took part in yesterday. This was my first ever webinar and also my first interaction

with your company and found it to be a beneficial and enjoyable experience. I look

forward to my next webinar and your tips etc."

Fiona, Office Manager, Brisbane, Australia

"The rapport between Paul and Grant was great and makes it more interesting than

a one way presentation."

Maureen, Accountant, Taupo, New Zealand

|

|

COURSE CANCELLATION POLICY

|

| |

|

Cancel up to five working days before the webinar and receive a full refund. All

cancellations must be notified in writing, that is, by email, fax or post.

Another delegate may be substituted at any time.

|

|